In tumultuous times such as these, and in consideration of the inherent nature of capital, it can be challenging to decide where and how to invest your money.

For many, the only option is to invest in ‘safe’ assets such as real estate, resting assured that their money and future are secure. But there is a myriad of lucrative opportunities and industries in which both first time and seasoned investors can get involved in, with the top-performing initiatives currently being Biotechnology, Cannabis, Artificial Intelligence and Real Estate.

Here we list the top 5 best investments of 2020:

Physical Commodities

Physical commodities, such as gold, silver and crude oil are investments that you physically own. These commodities often serve as a safety net during trying economic times. Generally, these are basic goods that can be altered into other goods and services. Commodity trading goes back centuries, even before stocks and bonds exchanged hands. It was a vital business, linking different cultures, countries and people together. From spices and silks in the early days to the exchanges where these assets are now traded, commodities are still a popular investment avenue.

Investors hoping to get into the commodity market have several different ways to do so. Commodity-keen investors can consider investing directly in the physical commodity, or indirectly by purchasing shares in commodity companies, mutual funds, or exchange traded funds (ETFs).

Healthcare

Despite the disruption to stock markets around the world caused by COVID-19, the healthcare sector continues to present substantial investment opportunities. These are being driven by demographic trends (such as the ageing population in many countries) and accelerated advances in medical science.

The current rapid pace of change across the sector, particularly regarding technology, makes investing in healthcare enticing.

There are a plethora of innovative and robust technologies emerging in both medicines, and technology/data that are providing new approaches to managing diseases, ensuring better patient outcomes more cost-effectively. The current pandemic has shone a significant spotlight on the importance of these technologies and their continued advancement.

While these changes have been a long time coming, investing in healthcare is now at a progressive and positive juncture, where genuine innovation and advancement across the sector can drive the returns of those companies at the forefront of innovation.

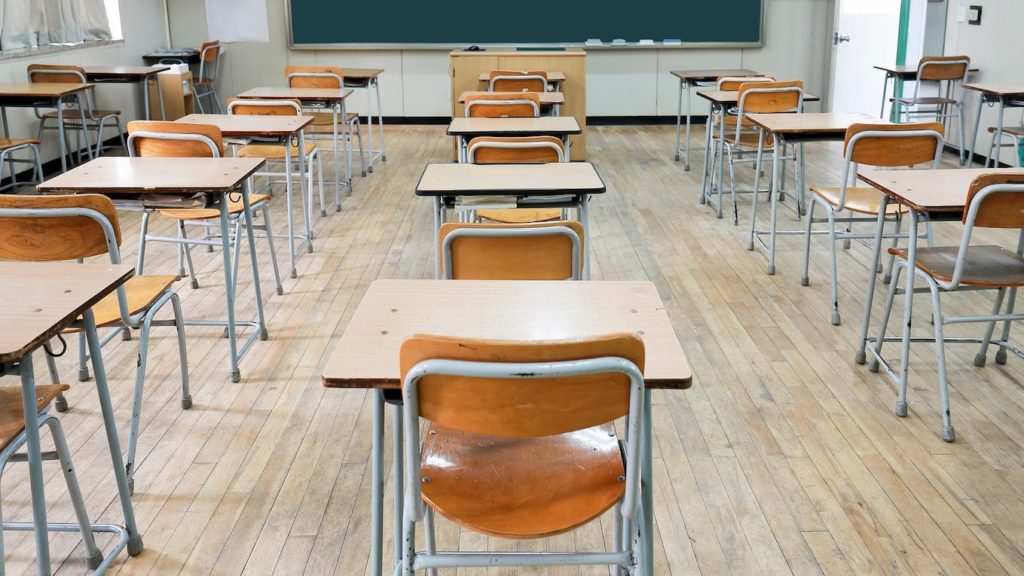

Education

Investors globally are growing more conscious of the need to combine generating returns with doing greater social good within their communities. Therefore, the social benefit of supporting the operation of a business that educates learners is becoming increasingly popular.

There are many such investment opportunities throughout the world, offering investors the chance to make a difference and invest in the future. Many private school companies are now listed on the stock exchange and provide high returns.

The business model is simple but effective. Once a school is built in a good location, and the cost structure is perfected, it becomes a case of getting in students. The operational leverage is high, and once the school breaks even, further enrolments add to the profit line.

This structure is also highly cashing. Fees are paid in advance, and bad debts are inclined to be very low. Furthermore, students can be at a school for many years, resulting in an annuity revenue stream with an expectation of some escalation every year, which all makes for a good business model.

Investing in education also speaks to a much larger global investment shift to Impact Investing.

Not only can impact investing produce financial returns, but it also pulls on those heartstrings tied to our social and environmental principles. Socially Responsible Investing (SRI) is a growing trend, with a booming market and exciting future.

The impact investing market is growing, targeting sectors such as renewable energy, conservation, sustainable agriculture. It also brings the promise of accessible and affordable basic services, including healthcare, housing, and education. And an investment that ticks all these boxes is Citizenship by Investment.

Citizenship by Investment

Citizenship by investment (CBI) programmes offer well-vetted individuals and their families the opportunity to legally acquire a second passport and citizenship in return for an investment in the economy of the host country. Investing in these programmes is a quick and easy process provided the applicants pass all the due diligence checks first, make a qualifying investment and provide all the correct documentation.

A wide range of countries in the world currently offer CBI, with a high concentration of CBI programmes in the Caribbean, a region considered the cradle of citizenship by investment.

There are many benefits to having a second citizenship, including greater global mobility, new economic opportunities, a better quality of life, and improved personal security. Leading the way in offering this sense of security is the dual-island nation of St Kitts and Nevis, which has the oldest and most respected CBI programme in the world. The government is currently running a limited time offer until 15 January which allows a family of up to four to apply for citizenship, for the same cost as that of a single application.

Also Read: More South Africans Are Becoming Citizens of the World

Similarly, the Commonwealth of Dominica has an impressive CBI programme that has been rated first in the world for the fourth year in a row by the CBI Index, a publication by The Financial Times, and is known for its family friendly approach. Aside from allowing citizenship to be passed down to future generations, the main applicant is also able to include extended family comprising of spouse, children, siblings, parents and grandparents in one application, with the option to add more family members in the future.

Property

Property has long been a popular option for investors, with many aspiring to own a property as it represents security, a legacy and a place to call your own. In order to own property, most people are required to apply for a home loan which, used sensibly, can also be a useful investment tool.

Traditionally, property has long tempted those seeking a place to ‘park’ their money because it tends to retain and gain in value, albeit over the long term. It can also be used as a useful mechanism for diversifying an investment portfolio. Over time, a property can also appreciate and further bolstering your investment.

Buying and owning real estate is an investment strategy that can be both satisfying and profitable. Unlike stock and bond investors, prospective property owners can use leverage to buy a property by paying a percentage of the total cost upfront, then paying off the balance, plus interest, over an extended period.

Whether you’re a stock market enthusiast, looking for income-generating investments or interested in diversifying into different industries, savvy investors should perform extensive due diligence with the help of a trusted financial advisor.

- Britain Set to Release the First Approved COVID-19 Vaccine in Coming Weeks - 6th December 2020

- 11 Most Cinematic Couples to Ever Grace the Silver Screen - 18th November 2020

- Iconic Brands That Have Prospered for Over 100 Years - 16th November 2020